Interview with Brian Scully, Business Development Manager

Ventac are Ireland’s leading noise control specialists based in their state of the art laboratory facilties in Blessington Co. Wicklow.

How do Ventac specialise for the Irish construction sector?

As a specialist acoustics company Ventac offer a comprehensive range of generic and bespoke building acoustic solutions which can be used at every stage of any construction project. Our range includes products that successfully reduce impact noise, air noise, structure borne noise, reverberation noise as well as containment of construction noise

| · Acoustic Flooring Products |

· Acoustic Insulation |

· Acoustic Battens |

| · Attenuators and Silencers |

· Rigid and Flexible Acoustic Screens |

· Rigid or Flexible Acoustic Enclosures |

| · Acoustic Panels – Walls and Ceilings |

· Baffles |

· Acoustic Louvres |

| · Anti-Vibration Mounts |

· Flexible Acoustic Jackets |

|

Fig. 1 – Ventac Acoustic Louvres

What makes Ventac unique?

Ventac is a complete solution provider to the construction sector for all Acoustic requirements. We design, manufacture and test a full range of bespoke Acoustic solutions. We have one of the most advanced acoustic laboratories in Europe at our headquarters in Blessington.

Our Acoustic Laboratory allows Ventac test and develop components and new products for the Construction market. So if the requirement is for a bespoke solution, we can fully test and evaluate performance before supply. This approach ensures the customer gets the right solution at the right cost, first time.

Fig. 2 – Ventac Acoustic Quilts

The construction industry is emerging from a sustained period of contraction. Where are the growth areas for your business?

The main areas for growth in 2016 will be projects within the Industrial and commercial sector in Ireland. Commercial developments such as hotels, auditoria, prestige office developments or corporate headquarters will often require high end acoustic treatments with a strong emphasis on the aesthetic.

We also see expansion in the food and dairy business as well as the pharmaceutical manufacturers and our acoustic treatments for air management and plant noise would be employed here. Silencers, attenuators, acoustic louvres or full scale acoustic enclosures for roof mounted services such as AHU’s, and Condenser fans.

The biggest growth area for Ventac over the last 30 months has been the Data Centre developments, where the acoustic treatment for air noise is paramount. Temperature levels and cooling requirements are critical to the running of these centres and that demand produces considerable noise levels.The solutions here require a strong knowledge of acoustics and construction, assembly and wind load calculations, being critical when the sheer size of the screens are considered.

Having already delivered acoustic solutions to a small number of data centres over the past two to three years we believe that hard earned experience should be of value when discussing future treatment options on new developments.

Fig. 3 – Ventac Pumping Station Housing

What are the challenges facing your industry?

I see the challenges for our industry falling under three main areas: Enforcement of the noise legislation regulations in Ireland. Capital expenditure for noise control in the workplace. Greater understanding of the benefits of noise control strategy.

I believe the new regulations relating to noise have received a mixed response and appear to be somewhat controversial. Care to expand?

Yes the new BS4142 regulation is proving to be somewhat problematic and in many cases is ignored unless enforced by the local authorities. Its certainly a hot topic both here and the UK with ambiguity in terms of interpretation and enforcements

Fig. 4 – Ventac Acoustic Enclosure

What recent projects have you been involved in?

Unfortunately, a lot of our larger projects are covered by NDA’s. Suffice to say in the last 18 months we’ve been involved in a number of projects within the commercial sector and the industrial manufacturing sector working with companies such as Cooley Distillery, Arabawn Dairies, Facebook, Baxter Healthcare, Stryker Group, Diageo and North Cork Co-Op. Our work with ESB and Bord Gais is something we are particularly proud of and is typical of our ongoing collaborative work with local authorities and semi-state organisations.

Fig. 5 – Ventac Knockraha ESB project work

How optimistic are you going into 2016?

Very optimistic! there are a number of key projects already under way and we see this continuing for 2016. We have seen through the number of new enquiries we have had this year that the Irish economy is rebounding strongly.

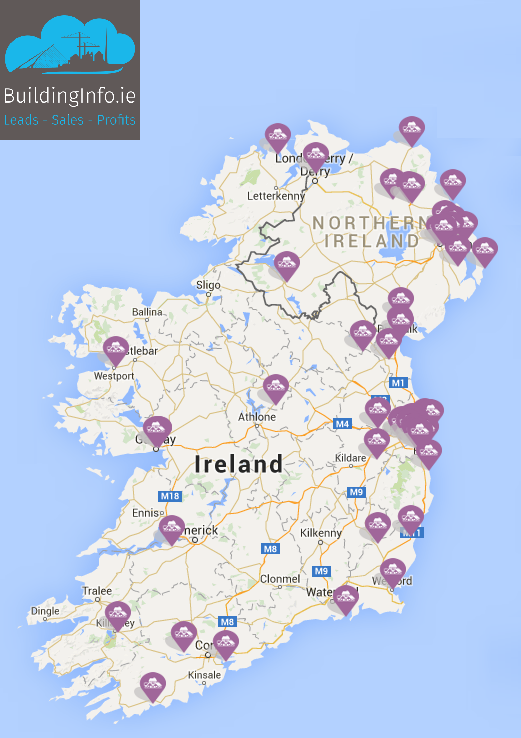

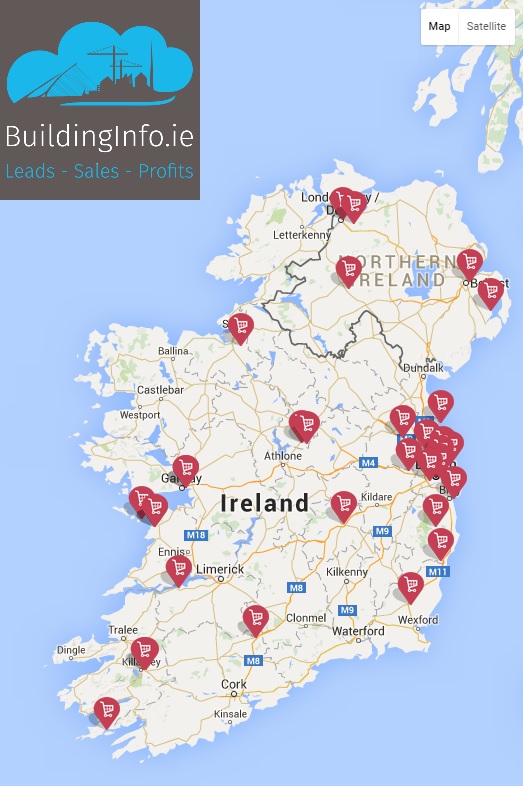

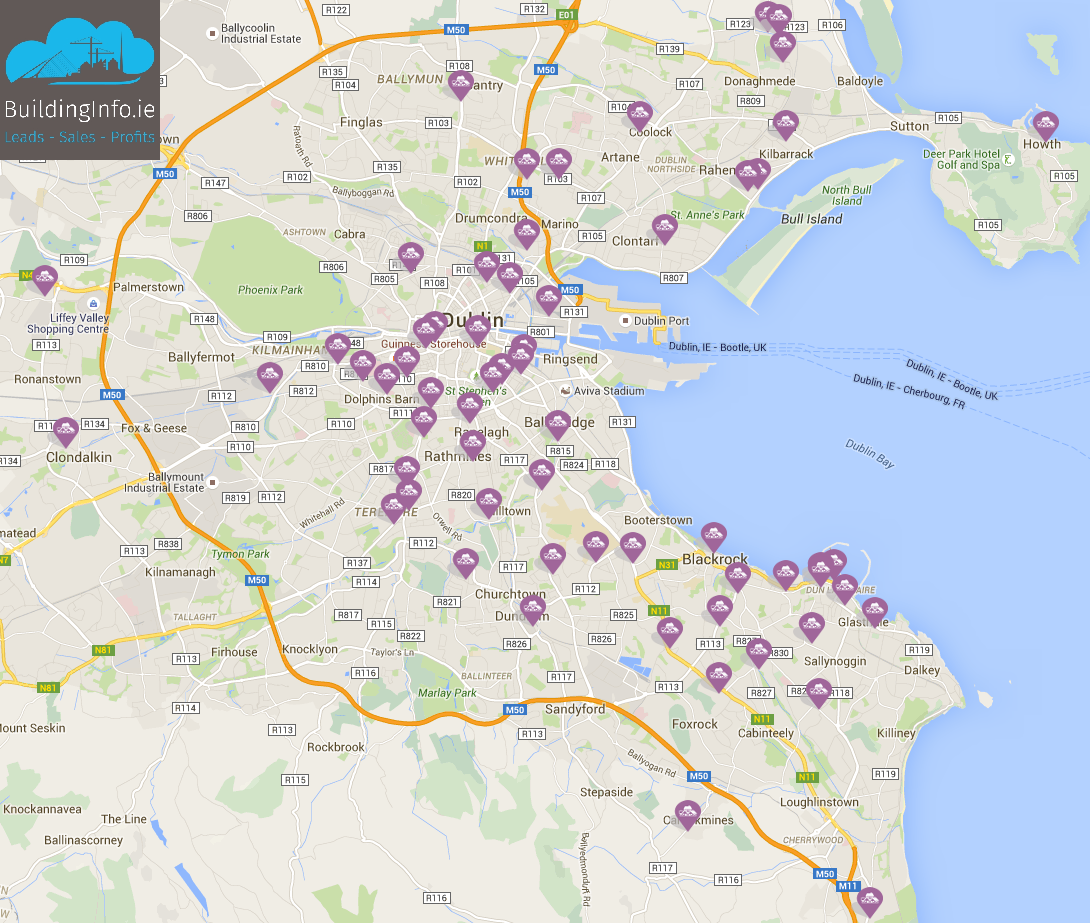

You’ve recently subscribed to Building Info – has it been beneficial to date?

Absolutely – BuildingInfo gives us a platform to promote Ventac and engage with the construction market. Our product offering is quite specialised so talking to the right people at the right time in terms of project development and solution options is paramount. BuildingInfo give us that level of information and visibility.

END

Details on Ventac range of services, products and expertise can be found on their website.

Call Brian Scully 045 851500 or email for further details