Below is an excellent article from Tina-Marie O’Neill that featured in The Sunday Business Post yesterday (06/09/15). Danny O’Shea CEO of Building Information Ireland provides an insight into the Residential Construction pipeline with some of the findings from the latest edition of the Building Information Index. Contributions from many of Ireland’s largest property consultants shed further light on the outlook for the Residential Housing sector.

New home scheme numbers on the up

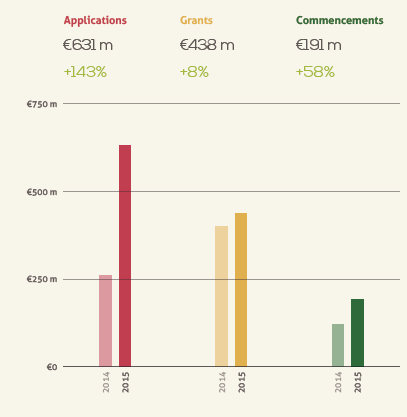

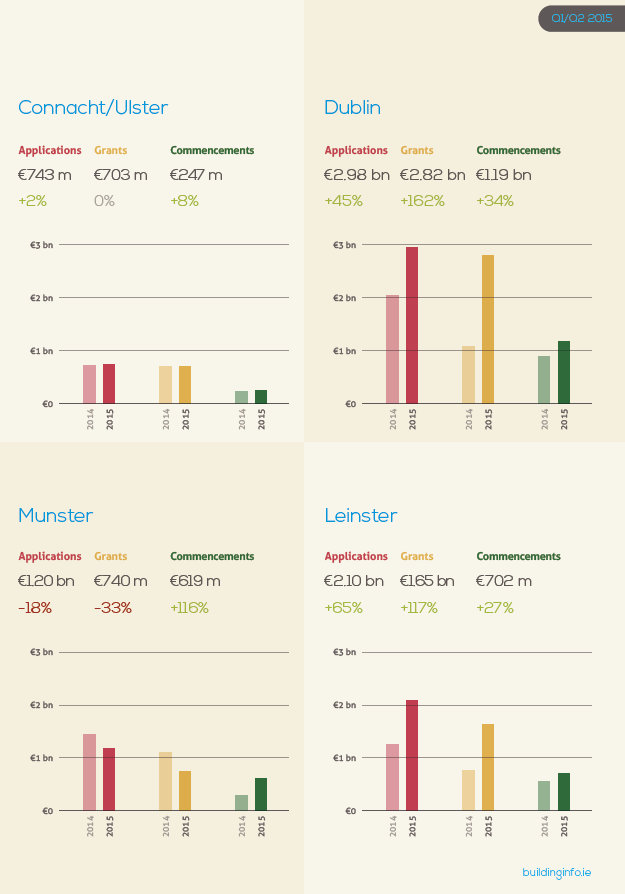

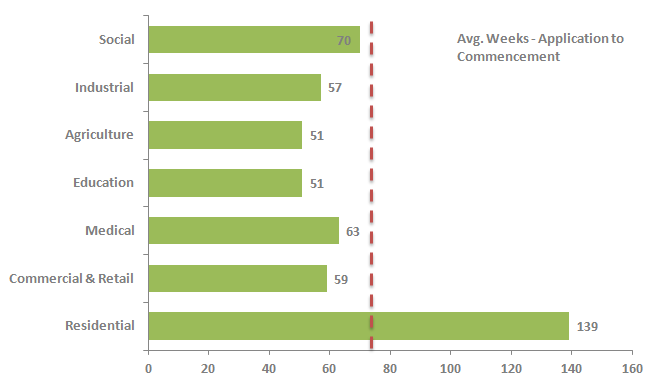

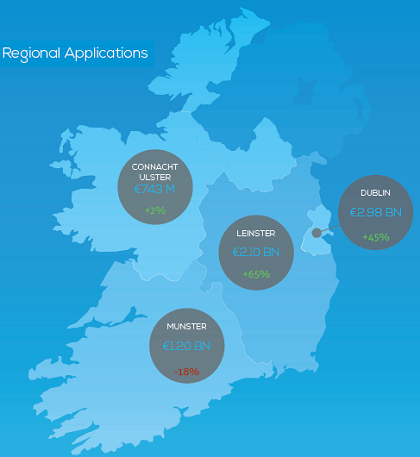

The number of new homes schemes under construction in Dublin – and increasingly in its surrounding commuter belt counties – is finally on the up. However, these green shoots of recovery in the residential market are in jeopardy of proving negligible, washed away by the sheer tide of demand for homes in the capital. The latest research from Building Information Ireland shows that residential housing projects with a combined quantity of 7,785 units began construction in the first half of 2015, (this number excludes “one off” houses, which are thought to make up almost half of all new homes currently being built). The estimated construction cost of these commencements is a healthy €1.43 billion. And according to the latest Building Information Index, residential housing project commencements showed an increase of more than 44 per cent in value when the first half of this year is compared to the same period in 2014. “Unsurprisingly, the bulk of these units starting to be built – some 3,143 – are in greater Dublin with a further 3,140 in Leinster,” said Danny O’Shea of Building Information Ireland. “Munster statistics show some 1,230 residential units were started this year with a much lower amount, a mere 272, started in Connacht/Ulster. “The pipeline for residential housing projects which are yet to start also shows signs of strong growth with 14,405 units (worth €3.13 billion in construction costs) granted permission in the first half of 2015,” said O’Shea. “There were an additional 18,355 units within new planning applications in the first six months of 2015. “However, a detailed analysis undertaken by Building Information Ireland shows a significant lead time of 139 weeks – or more than two-and-a-half years – on average between planning being applied for a residential development and construction starting on site,” said O’Shea. It could easily take another year for the first tranche of homes to be delivered once building has commenced. That puts in stark figures what most property buyers already know; there simply are not enough residential units on the market to meet demand in the capital. Current construction levels are operating at about a third of the volume required and with rising rents, demand remains tremendous. “Now that the holidays are over we are experiencing a steady increase in enquiries for upcoming new home developments in and around Dublin,” said Ken MacDonald, founder and director of Hooke & MacDonald. “Most of the demand is coming from first-time buyers seeking three and four bedroom houses and two bedroom apartments. There’s also good demand from existing owner occupiers wishing to trade up from smaller properties to more spacious family homes and, conversely, there are also retirees actively seeking to trade down from large houses to smaller houses or apartments. Due to the buoyant rental market, investors are becoming quite active again, although many investors are exiting the market due to the unfavourable tax regime and speculation about pending rental capping,” he said. MacDonald criticised the new Central Bank minimum mortgage deposit rules for exacerbating the issue. “Notwithstanding the increase in enquiries and sales, a substantial number of people, particularly first time buyers, are being unfairly excluded from buying due to the Central Bank mortgage restrictions. The reality is that prices in the market had already cooled from September 2014 and have continued to moderate or remain fairly static,” he said. “Some commentators mistakenly attribute this to the mortgage restriction which only came in after Christmas. The exclusion of people from buying is adding to the shortage of supply in the rental market and there are no signs of any moves to increase supply in this sector. Rental cap measures, if introduced, will actually decrease supply,” warned MacDonald. Angela Keegan, managing director of MyHome.ie, is also concerned that rising rents will intensify the issue. She has also urged a greater diversity of units to be built as cautious developers are catering to a specific block of house hunters. “Given the current market pressures, it’s unfortunate to see so few apartment developments coming to the market,” she said. “We see only one development of one-bed apartments, six of two-beds and two of three-beds in our analysis. With rents on the rise, the government clearly needs to incentivise the property investment market to cater for current demand. “We are seeing a major increase in the number of new developments coming to the market in Dublin and commuter belt counties. Of the 45 developments in Dublin, 20 are concentrated in south Dublin with Dublin 14 and 16 being particular hot spots. West Dublin is also quite strong with nine schemes launched at the moment, mostly in Castleknock, Lucan and Clonsilla. “However, it’s hard to get a handle on exact volumes as schemes are being released in different phases. There is one development in Swords of 85 units coming to the market, but that is the exception. “Generally it looks as if developers are adopting a much more prudent approach and building homes to cater for first time buyer demand rather than investment properties. That is very much reflected in the type of properties being built with the focus very much on three and four-bed semis.” Among the tranche of mainly small developers that have either survived or emerged from the recession are a limited number of familiar Celtic Tiger era residential property developers, including the Cosgrave Group, which continues to deliver high end four and five-bed family homes in both north and south Dublin, Sean Mulryan’s Ballymore Properties, Gerry Gannon of Gannon Homes, Park Developments and Durkan Estates, who are all currently active in new homes schemes. Keegan said: “Another trend we are seeing is that Dublin city is continuing to spread into the commuter belt counties. “We are seeing a lot of new schemes in Bray, Newtownmountkennedy, Naas, Celbridge, Clonee etc. This may well be in response to tighter mortgage lending limits introduced by the Central Bank earlier this year. Our analysis also shows that the further out you move from the city, the larger the homes being built.” For the many potential new home buyers out there, Gina Kennedy of Douglas Newman Good (DNG) New Homes has this advice: “Look around, do your research and register your details or sign up to waiting lists for schemes in your preferred area. Buyers have to be alert to launch dates and general invitations of interest in schemes. This sector of the market can change quickly given that releases can be dependent on completions, near completions or can be sold off-plan,” said Kennedy. “We are often approached by potential buyers before we even erect our hoarding on site who want to be put on waiting lists. “We’ve a lot of new schemes in the pipeline too with a good volume coming on stream early next year, including schemes with new phase releases and brand new developments too.” Upcoming launches Six four-bed semis of 172 square metres at Heatherton in Bray for Heatherbrook Homes, priced from €495,000 through Hooke & MacDonald in mid-October. The same agent will launch 12 large four-beds (197 – 254 square metres) at Ardilea Crescent in Clonskeagh, Dublin 14 for O’Malley Construction next February. Hooke & MacDonald will also launch a number of three and four-bed homes at Cuil Duin in Citywest, Co Dublin as part of the first phase of the 200-home scheme in December. Savills is launching four and five-bed homes at Emsworth Park in Kinsealy later this week. The same agent will also handle the release of three, four and five-bed homes at Piper’s Hill in Naas, a Ballymore scheme, with units priced from €325,000 and spanning between 124 and 251 square metres. Ely Woods, a scheme of 35 units in Rathfarnham will offer a number of two and three-bed duplex units and apartments for sale through Savills later this month. Maybury Properties is releasing a number of three and four-bed homes at its 35-unit scheme at Cooper’s Wood in Kinsealy, also through Savills, at the end of September/early October. Guardian New Homes will launch a small scheme of six family homes spanning 171 to 176 square metres at Richmond Close on the Dundrum Road in Milltown in Dublin 6 later this month. Sherry FitzGerald will shortly launch four-bed family homes for sale at The Grove on Goatstown Road in Dublin 14. The 163 square metre homes are being built by Durkan Estates.